Why Asset Allocation Is the Backbone of Good Investing

Learn how mixing assets wisely can protect your money, reduce stress, and build real long-term wealth.

Bunny was sweating as if he had lost his new iPhone Pro Max.

“Uncle… mera equity mutual fund 20% down hai. Kya main sab kuch galat kar raha hoon?”

He wasn’t crying—but his Equity ONLY portfolio was.

He had put all his hard-earned money—every single rupee—into equity mutual funds. Because someone in a video, in a loud voice said, “Long-term me equities always work.”

Now that the market had fallen, Bunny’s blood pressure was up, and his belief system was down.

He wasn’t scared of investing.

He was scared of being wrong.

Hero = Bunny is our classic Indian investor. Curious, committed, but currently confused.

Guide = Investing Uncle has the old-school patience + new-school gyaan. A bit of comic relief with serious money wisdom.

The PROBLEM: Bunny Was Doing things “Right”… But Felt Wrong.

“Uncle, sab paisa equity mein invested hai mera. Maine Whatsapp University se Investing seekhi hai”

He had gone from "FD se kuch nahi hota" to "Equity hi sab kuch hai."

His confidence was built on just one leg—equity.

And when that leg broke, his whole strategy collapsed.

“Bunny,” I said with a smile, “Tum apni financial life ek taang pe balance kar rahe ho, ek din to Girna hi tha!”

I poured him a cup of adrak wali chai and said:

“Bunny, investing mein sirf equity se paisa nahi banta. Stability + growth dono chahiye. Hero banne ke chakkar mein kabhi kabhi hum portfolio ke villain bann jaate hain aur humme pata bhi nhi hota.”

He looked at me like I was Sensex in human form.

“Then what should I do, Uncle?”

PLAN GIVEN – The Desi Thali of Investing: Asset Allocation

“Asset Allocation,” I said, “is like our Indian thali.”

You don’t eat only paneer. You don’t ignore daal. You need:

Some spicy (equity for growth),

Some mild (debt for safety),

Some pickle (gold for spice),

And some curd (emergency fund for cooling effect).

What Is Asset Allocation?

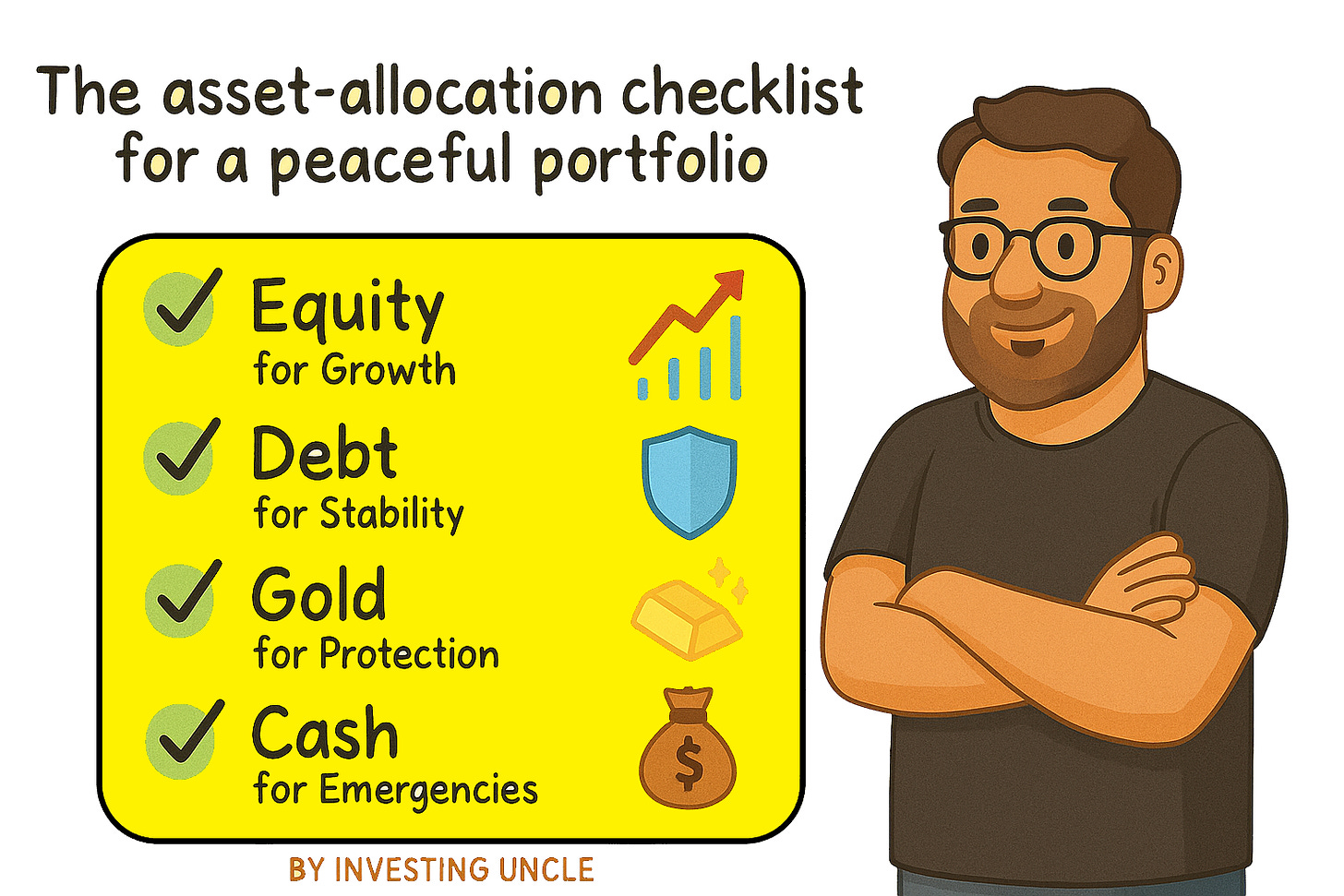

It's the simple art of dividing your money across:

Equity (growth)

Debt (stability)

Gold (diversification)

Cash (liquidity)

Why It Works:

When equity falls, debt cushions you.

When markets rise, equity boosts returns.

When both zigzag, gold often shines.

When emergencies come, cash keeps you calm.

“Bunny, portfolio balanced hona chahiye – matlab minimum Two-asset classes (preferably Equity and Debt)

BENEFITS SHOWN – Bunny Starts Seeing Clearly

I showed Bunny three versions of himself on paper:

Version 1:

Asset - 100% Equity

Outcome - High return, high blood pressure

Version 2:

Asset - 100% FD

Outcome - Safe, but can't beat inflation

Version 3:

Asset Mix - 65% Equity + 35% Debt

Outcome - Growth + safety + peace of mind

He stared at Version 3 and smiled.

“Toh Uncle, iska matlab ye hai ki… main equity ke saath-saath thoda Debt me bhi invest kru?”

“Exactly, Bunny! Allocation is not about return chasing, it’s about regret saving.”

TRANSFORMATION – Bunny Finds His Balance

Bunny went home, opened his app, and started re-balancing his portfolio.

He moved a portion of equity into debt funds.

He added a small SIP in gold ETF.

He parked 6 months expenses in a liquid fund.

Within a week, he looked younger, wiser and calmer.

“Uncle, ab main stock market girne se tension nahi leta.”

I raised my chai cup.

“Toh asset allocation ki jai ho!”

“If Bunny Can, So Can You be a Hero”

Dear reader, if Bunny can pause and fix his foundation, so can you.

Asset allocation is not for the rich.

It’s not for the experts.

It’s for every wise investor who wants to live stress-free, not market-free.

You don’t need to pick the best fund.

You need to build the right mix.

Because in investing, winning isn’t just about more. It’s about balance.

P.S. If you’re still confused between saving and investing, read our earlier blog: “Saving vs Investing: Don’t Let Your Money Just Sit There”.

BUNNY = WINNER

Bunny now sleeps much better.

Markets may rise. May fall.

But his asset-allocation keeps him standing.

He jokes with me now,

“Uncle, ab mere pass Two-Two SIPs hain, Systematic Investment Plan and Sleep-in-Peace.”

“Asset allocation is like the foundation of a house — not exciting, but absolutely essential”

Felt like a relaxing chai break?

Share this with friends who’s only investing in equity and sleeping 4 hours.

And if you want more Bunny-style wisdom every Sunday at 09:15AM, hit that subscribe button.

Investing Uncle,

Over and Out (but always asset-allocated)

Hope this blog adds real value to your long-term investing journey.

If YES, Maybe you treat Uncle with a cup of Tea?

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully before investing. The past performance of the mutual funds is not necessarily indicative of future performance of the schemes. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax and financial implications of the investment/participation. This blog/Website is for Educational purpose only. Any reference should not be treated as any form of Financial Advice.

Any person referred to in this post is purely coincidental. The characters, names, and situations mentioned are for illustrative and educational purposes only and are not intended to represent any real individual.

‘Investing Uncle’ is NISM Series V-A Certified (Mutual Fund Distributor’s Certification Examination) conducted by National Institute of Securities Markets (NISM)

Investing Uncle is not SEBI/AMFI Registered.