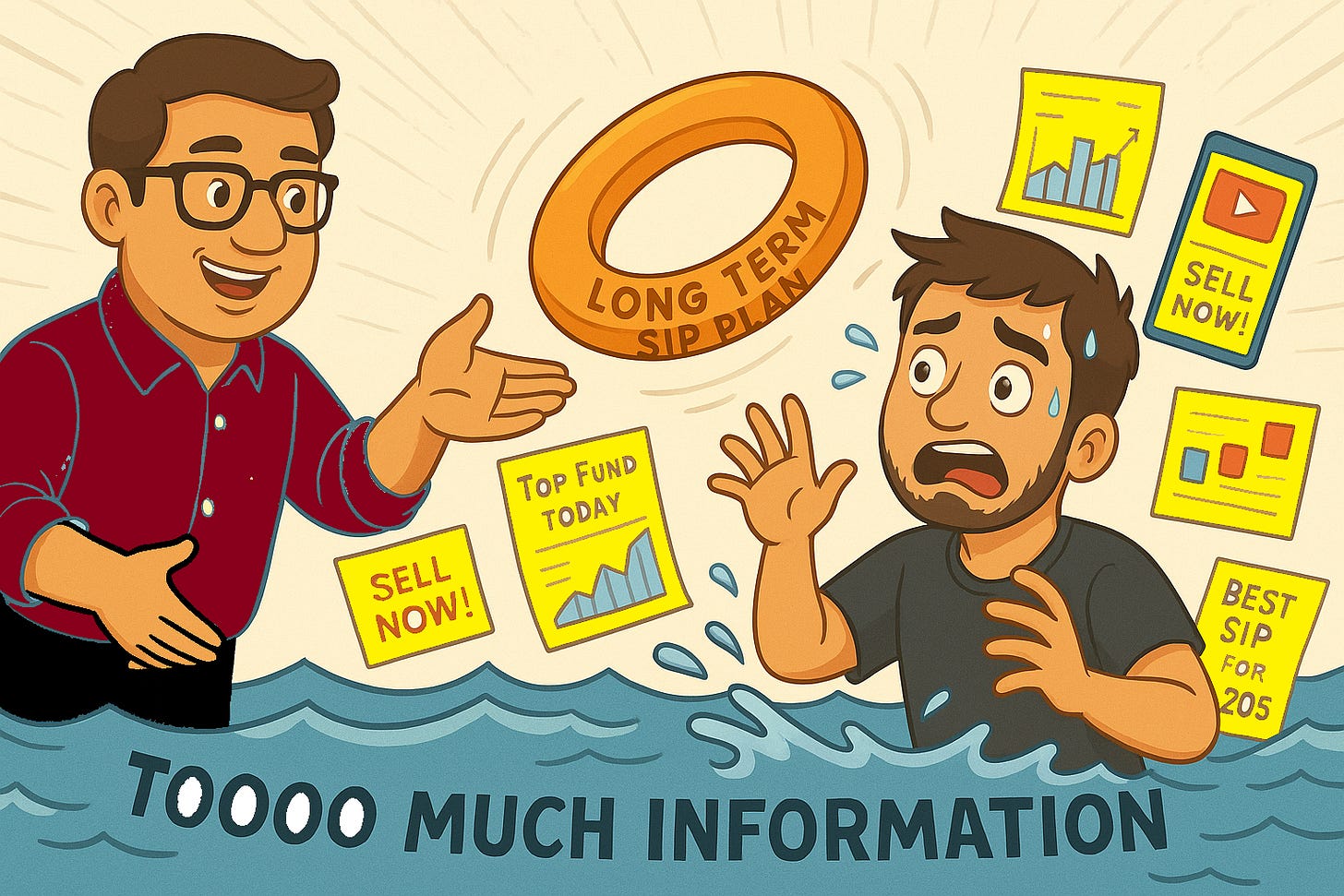

Overthinking Kills Returns: The Danger of Too Much Information

This blog reveals how information overload harms investors — and what to do instead.

“Mujhe sab pata hai… par fir bhi nuksaan ho raha hai!”

Bunny had three tabs open:

A YouTube video titled “Best Mutual Fund for 2025 (Updated hourly!)”

A reel where a 19-year-old “finance guru” was yelling: “Don’t invest in SIPs, bro!”

And an article titled “Why mutual funds are SCAMS.”

He looked like a WiFi router with 19 antennas and zero signal. Confused. Stuck. Scared.

“Uncle... I read everything… but ab zayada confusion ho rahi hai,” Bunny said, scratching his head.

“Pehle knowledge nahi thi… ab overdose hai.”

Investing Uncle (your friendly neighbourhood firewall)

I looked at Bunny and smiled.

“Bunny, pehle tum andhere mein the. Ab tum disco mein ho. Dono hi jagah, kuch nahi dikhta.”

He blinked.

“Over-information is the new ignorance, Bunny. Tum itna zayada investing gyaan le rahe ho ki information paralysis ho gaya hai tumhe.”

The Problem – Bunny drowning in data

Bunny had started his investing journey with hope.

But within weeks, he was paralysed by conflicting advice:

“Buy the dip!” vs “Don’t catch a falling knife!”

“SIP karo long term ke liye!” vs “SIP is for losers!”

“This fund gave 80% return!” vs “Past returns matter nahi karte!”

His portfolio wasn’t growing. His confidence was shrinking.

He had become a full-time financial researcher… but a part-time investor.

The Guide, Investing Uncle – “Pehle chai, phir clarity.”

I poured two chais and said:

“Bunny, main bhi kabhi tumhare jaisa tha.

Par dheere-dheere samajh gaya:

Zyada gyaan se paisa nahi banta. Sahi sochne se banta hai.”

“Main tumhe ek simple framework dunga. No fancy words. Just common-sense.”

The Plan – “3-Filter System” (3FS) to Fight Overload

“Tum jab bhi koi investing info dekho — apply these 3 filters,” I said:

Intent Filter – Yeh bolne wale ka motive kya hai?

Are they selling a course?

Wanting views, likes, claps, followers?

Trying to look smarter than they are?

“Zyada confident aadmi ka matlab yeh nahi ki wo tumhe sahi raasta dikha dega”

2. Relevance Filter – Kya yeh meri investing journey ke liye useful hai?

You’re a long-term mutual fund investor.

Kya penny stocks, option trading aur intraday tips ka tumhari life se lena dena hai?

“Finance ka bhi menu hota hai Bunny… sab kuch khane se pet kharab ho jata hai”

3. Action Filter – Kya yeh info se main kuch actionable kar sakta hoon?

“US mein interest rate badh gaya” sounds scary… but is it relevant to your SIP?

If you can’t act on it — ignore it.

Bunny starts seeing clearly

Bunny applied the 3-filter system for two-months.

Suddenly:

He stopped watching 13 videos a day.

He unsubscribed from panic-inducing finance social media groups.

He made one clear investment decision:

“Main bas 3 funds mein SIP karunga. Aur har mahine ek baar hi portfolio check karunga.”

He was investing. Sleeping better. And smiling more.

The Transformation – From Overloaded to Empowered

Bunny said:

“Uncle, aap sahi kehte ho — Zyada sochne se paisa nahi banta. Discipline se banta hai.”

He was no longer reacting to every headline.

No longer asking 5 different people before investing Rs. 1,000.

He had turned off the noise. And tuned into wisdom.

"Ignorance bhi dushman hai… par over-information uska bada bhai hai"

Last time, Bunny learned how ignorance ruins investors.

(Read: “Ignorance in Investing: The Silent Killer of Your Wealth”)

But today, he saw the dark side of too much knowing.

Don’t try to become Google.

Become Bunny 2.0 — who listens, thinks, and acts wisely.

Bunny = Hero. Reader (You) = Hero.

Bunny isn’t trying to read everything now.

He just follows a clear, calm plan — and filters out the noise.

And so can you.

If you’ve ever felt overwhelmed by finance gyaan, just breathe.

You don’t need more info.

You need better filters.

“Duniya ke pass information ka overload hai. Aapke paas hona chahiye, a clear written-down Investment Long Term Plan”

Save this blog.

Share it with your Social Media over-informed investor.

And subscribe to Investing Uncle — because clarity is the best investment.

Chai toh sab pilaate hain.

Main sahi soch pilata hoon.

See you next Sunday at 09:15AM.

Hope this blog adds real value to your long-term investing journey.

If YES, Maybe you treat Uncle with a cup of Tea?

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully before investing. The past performance of the mutual funds is not necessarily indicative of future performance of the schemes. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax and financial implications of the investment/participation. This blog/Website is for Educational purpose only. Any reference should not be treated as any form of Financial Advice.

Any person referred to in this post is purely coincidental. The characters, names, and situations mentioned are for illustrative and educational purposes only and are not intended to represent any real individual.

‘Investing Uncle’ is NISM Series V-A Certified (Mutual Fund Distributor’s Certification Examination) conducted by National Institute of Securities Markets (NISM)

Investing Uncle is not SEBI/AMFI Registered.