Needs vs Wants: Master This One Rule to Save Big

Learn the simple wisdom to stop overspending and start saving smartly.

Bunny was staring at his credit card bill and said: “Kya kar diya maine?”

In just one month, he had bought wireless earbuds (he already had two), the latest smart watch, a mini popcorn maker (used once) and the most awaited new iPhone Pro Max.

Deep down, he knew he didn’t need these things. But in the moment, everything had felt urgent. Reward and Social Status worthy.

Now? His wallet was crying loud and louder.

Characters - Hero & Guide (Not Dev Anand)

Bunny = Our sweet hero.

Investing Uncle = The calm, wise chai-drinking guide.

Bunny’s Meltdown

“Uncleeeee,” Bunny groaned, slumping into the plastic chair on my balcony.

“Why do I keep buying useless things? Mera budget and financial planning puri kharab chal rahi hai, month-after-month.”

I handed him a cup of chai.

“Bunny, problem shopping ki nahi hai. Problem clarity ki hai.”

He blinked. “Huh?”

I smiled, “Tum apne ‘wants’ ko ‘needs’ samajh rahe ho. Aur fir, Amazon ka ‘Buy Now’ button dikh jaata hai – that’s it, End Games of your financial plan.”

The Problem - Bunny is Confused between Needs & Wants

“I thought I needed that smart watch, Uncle! It was on sale!”

“And the 3rd pair of wireless earbuds?” I raised an eyebrow.

Bunny looked sheepish. “Umm… backup?”

“Bunny,” I sipped my chai slowly, “3 wireless earbuds, is not backup. It’s Financially Destructive Habits.”

Uncle Explains

“Let me explain needs vs wants”, I said, drawing two circles on a paper.

1. Needs - Things that help you live.

Roti, Kapda, Makaan.

Internet bhi - kyunki bina Internet ke ‘Investing Uncle’ ke blogs kaise padoge...

2. Wants - Things that help you feel fancy/cool/socially accepting.

Designer chai mugs, a ₹3,000 shirt you wore once to impress your crush (who didn’t notice), new phone - every September, and the list goes no.

Plan Given – 3-Step Filter to Identify “Needs vs Wants”

“Next time you want to buy something, use this quick 3-question test,” I told Bunny:

1. Will my life get worse without it?

- Yes = Need.

- No = Want.

2. Can I delay this by a month without major impact?

- No = Need

- Yes = Want.

3. Is this solving a real problem or a temporary mood?

- If, a problem = Need

- If, a mood = Want.

Bunny nodded slowly, “So Uncle, that wireless earbuds… were definitely a mood?”

“YES”

Bunny’s Eyes Open

He took a deep breath and looked at me.

“Uncle, if I stop confusing wants as needs, I can actually start saving.”

“Exactly! Wants are unlimited. But your salary isn’t. When you focus on needs, you build real wealth - not just Credit Card points.”

“And maybe I’ll feel less guilty after every shopping spree”

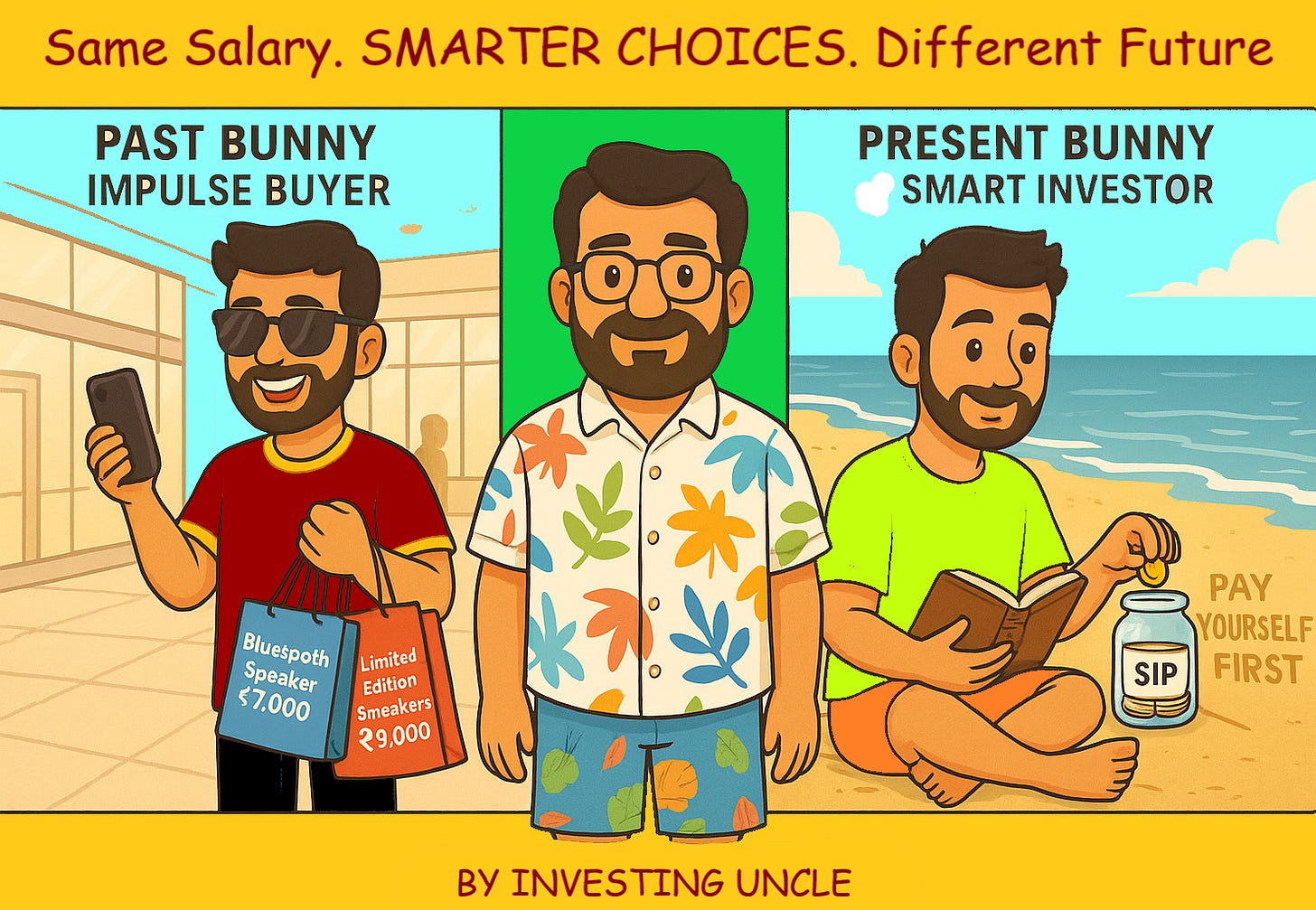

Transformation – Bunny Feels Empowered

A week later, Bunny messaged me:

“Uncle, I skipped this online sale. Invested the same savings as LUMPSUM in mutual funds instead.”

He was finally becoming the kind of investor who buys peace of mind.

Just like when we talked about panic selling in our earlier blog - once you understand your real needs, the fear calms down.

(Check that blog: “Why Investors Panic Sell (And How to Calm Your Inner Self)”)

“If Bunny Can Do It… So Can You, My Reader”

You’ve also had your “Bunny moments,” haven’t you?

That thing you bought… that’s still in its box… under your bed… next to last year’s “fitness mat.”

But now you know the secret chai filter:

Needs = survival. Wants = decoration.

Master this, and your budget will finally breathe again.

And so will your future.

“Wants make noise. Needs make sense. Choose your volume wisely.”

Got some clarity?

If YES, Maybe you treat Uncle with a cup of Tea?

Your support fuels this wisdom-filled ride, one story at a time.

See you every Sunday at 09:15 AM.

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully before investing. The past performance of the mutual funds is not necessarily indicative of future performance of the schemes. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax and financial implications of the investment/participation. This blog/Website is for Educational purpose only. Any reference should not be treated as any form of Financial Advice.

Any person referred to in this post is purely coincidental. The characters, names, and situations mentioned are for illustrative and educational purposes only and are not intended to represent any real individual.

‘Investing Uncle’ is NISM Series V-A Certified (Mutual Fund Distributor’s Certification Examination) conducted by National Institute of Securities Markets (NISM)

Investing Uncle is not SEBI/AMFI Registered.